Renters Insurance in and around Charlottesvle

Looking for renters insurance in Charlottesvle?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or space, renters insurance can be the right next step to protect your personal property, including your bed, books, guitar, smartphone, and more.

Looking for renters insurance in Charlottesvle?

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

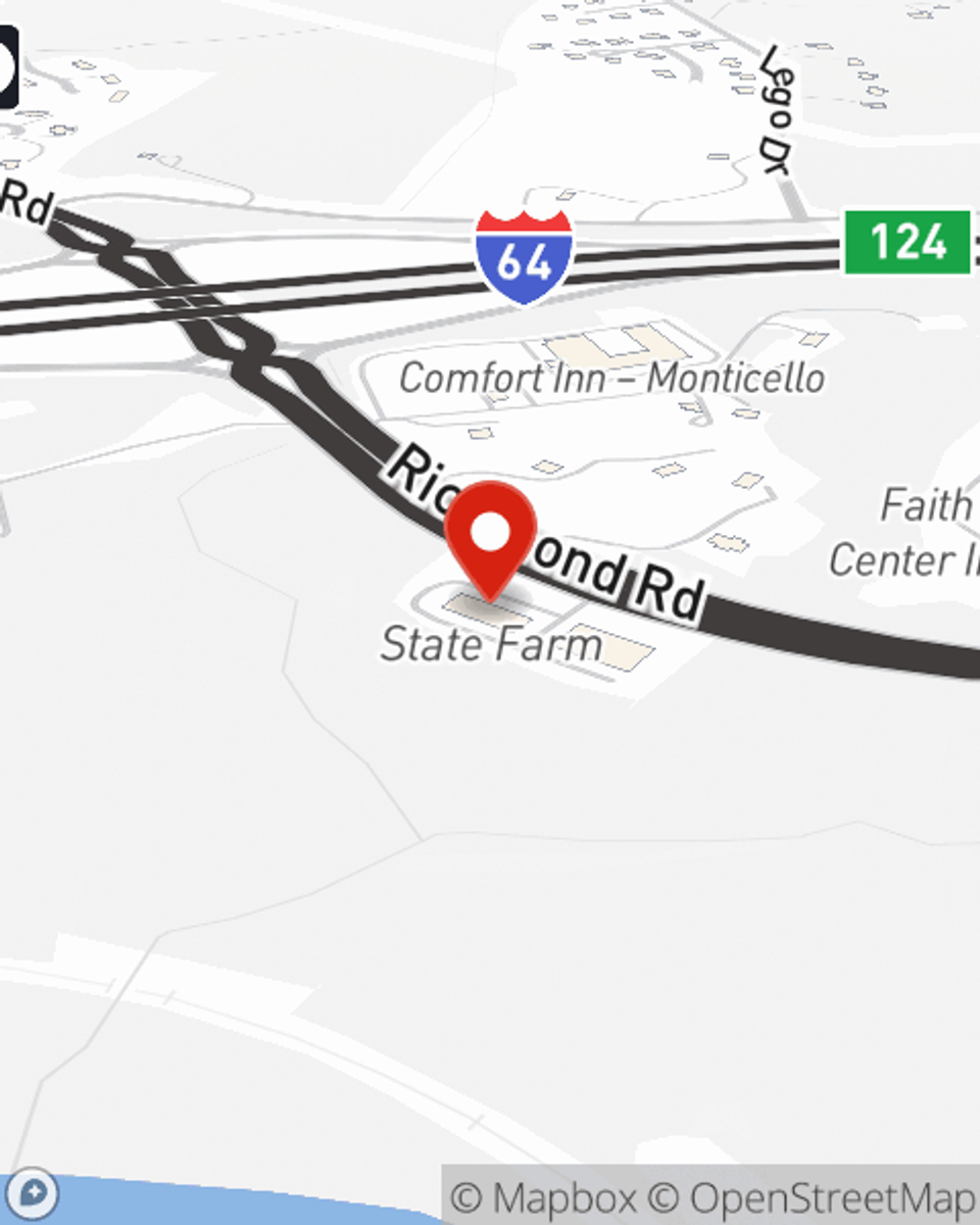

Renting is the smart choice for lots of people in Charlottesvle. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance probably covers water damage to walls and floors or an abrupt leak that causes water damage, what about the things you own? Finding the right coverage helps your Charlottesvle rental be a sweet place to be. State Farm has coverage options to match your specific needs. Thank goodness that you won’t have to figure that out by yourself. With personal attention and fantastic customer service, Agent Greg Bartleski can walk you through every step to help you develop a policy that guards the rental you call home and everything you’ve invested in.

There's no better time than the present! Reach out to Greg Bartleski's office today to talk about the advantages of choosing State Farm.

Have More Questions About Renters Insurance?

Call Greg at (434) 977-0203 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Greg Bartleski

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.